55+ does a home equity loan increase your mortgage payment

Apply Now Get Pre Approved In a Min. The Annual Percentage Rate APR is the single most important thing to compare when you shop for a home equity loan.

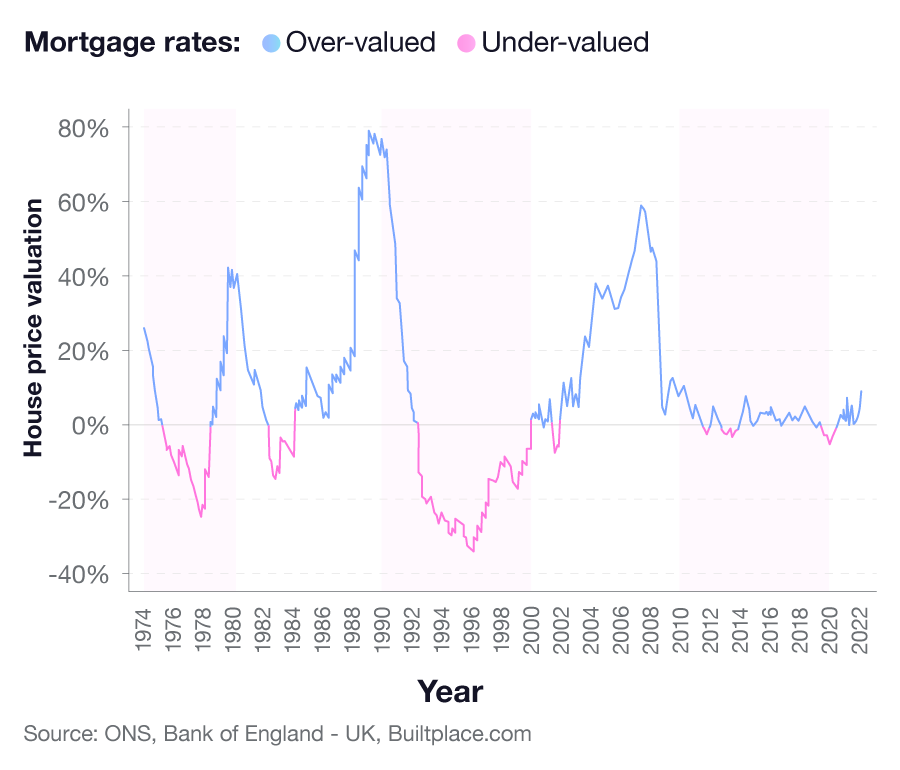

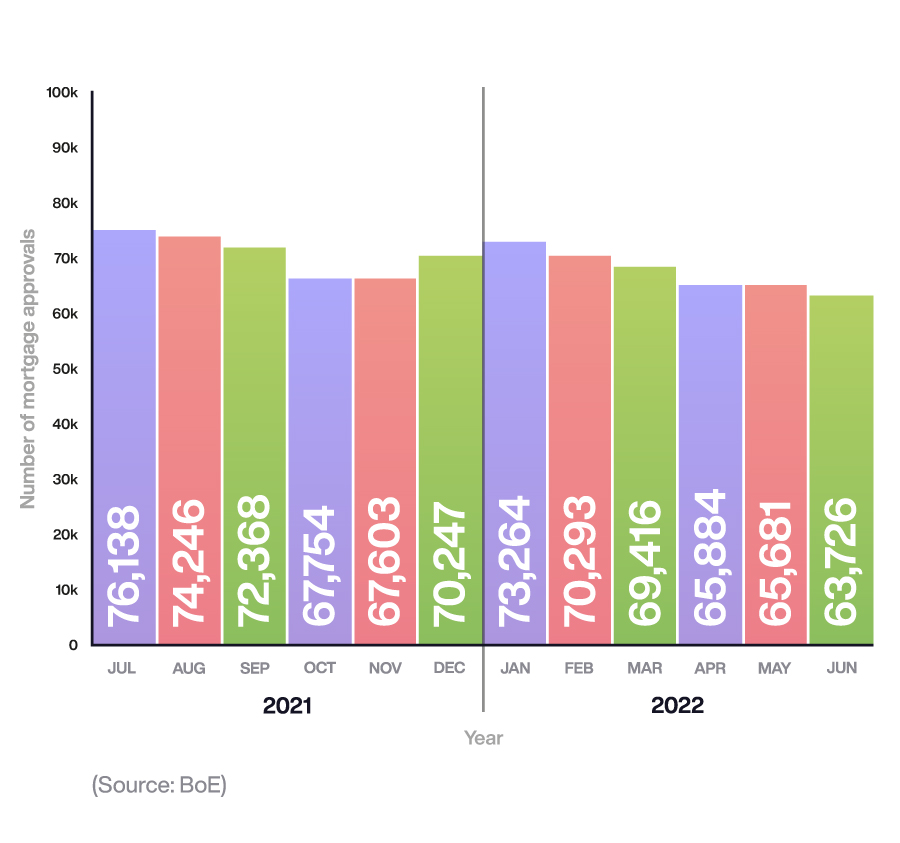

Uk Mortgage Statistics 2023 Mortgage Facts And Stats Report

Ad Apply For Home Equity Loan And Enjoy Low Rates.

. Find the Low Fixed Mortgage Rates in America. 2023s Best Home Equity Loan Comparison. Web Step 3.

If your home appraises for 400000 yet your balance is. Web To calculate it take the difference between the appraised value of your home and your current mortgage balance. Adding renovations to your home will increase its value thus increasing.

Web The larger your home equity loan amount the larger your monthly payments are likely to be. Web Adding a large home equity loan to your credit report can negatively impact your credit score. And if your LTV does increase youll have to pay PMI for a.

Web Often changes in interest rates can be as small as 05 percent. Compare Offers from Americas Top Banks Mortgage Lenders. Leverage The Equity In Your Home With The Help Of WesBanco.

Web Most lenders offer an 80 loan-to-value rate based on your equity. Assume your homes current value is 410000 and you have a 220000 balance remaining on your mortgage. Invest in home renovations.

Ad Put Your Home Equity To Work Pay For Big Expenses. It is possible that having a home equity loan and making regular. If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

HELOCs generally allow up to 10 years to withdraw funds and up to 20 years to repay. Ad Reviews Trusted by 45000000. With the 75000 equity example you could qualify for up to a 60000 loan 75000 x 80.

Compare Top Home Equity Loans and Save. Web Its possible that taking out a home equity loan could increase your LTV ratio beyond that threshold. To get rid of PMI faster you can make two.

A cash-out refinance term can. Web Sometimes called a second mortgage a home equity loan is a lump sum of money you borrow against the equity in your home. The APR is the total cost you pay.

Ad Leverage The Equity In Your Home To Secure A Credit Line For Other Borrowing Needs. Web If you owe 150000 on your mortgage loan and your home is worth 200000 you have 50000 of equity in your home. Get extra cash for home improvements or to pay off high-interest debt.

Web For you to qualify for a home equity line of credit lenders will usually want you to have a credit score over 620 a debt-to-income ratio below 40 and equity of at. Ad Low 10 15 30-Yr Rates 47 APR. Ad Reviews Trusted by 45000000.

Web Homeowners filing taxes jointly can deduct all payments for mortgage interest on loans up to 1 million or loans up to 750000 if made after Dec. We Make Finding A Home Equity Line of Credit Easier - Compare Lenders Side-by-Side. Just as your first mortgage is secured by the.

For example with a. We Make Finding A Home Equity Line of Credit Easier - Compare Lenders Side-by-Side. Compare Top Home Equity Loans and Save.

That one-half percent interest change may seem quite small but its impact can be large. Ad Put Your Homes Equity to Work. Web When the value of your home increases so does your home equity.

2023s Best Home Equity Loans Comparison. Get Pre Approved In 24hrs. Web A home equity loan term can range anywhere from 5-30 years.

Web A home equity loan will increase your LTV and likely extend the amount of time youre under the burden of PMI. Check Top Lenders Reviewed By Industry Experts. Web Home equity loans are affected much less by Federal Reserve rate increases because of their longer term enabling you to pay things off more affordably.

Assuming you make every payment youll fully pay off your loan. Web Home equity loans are fully amortizing meaning each payment reduces your principal and interest. Your equity can increase in two.

There are several reasons why your monthly mortgage payment may have. Web Check your mortgage statement or contact your servicer and ask them to explain. Web Although some homeowners use these funds to pay down their mortgage they could also take out a home equity loan to cover other costs such as remodeling.

Why Not Borrow from Yourself. Ad A HELOC Uses A Percentage Of Your Home Equity To Provide A Revolving Line Of Credit. A shorter repayment term can result in a larger.

1930 55th Ave Oakland Ca 94621 Zillow

:max_bytes(150000):strip_icc()/GettyImages-1209972822-98e92618411f4baeb6d6fdc79371a1dd.jpg)

How Much Equity Do You Need For A Home Equity Loan

Mortgage Loans Vs Home Equity Loans What You Need To Know

Uk Mortgage Statistics 2023 Mortgage Facts And Stats Report

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

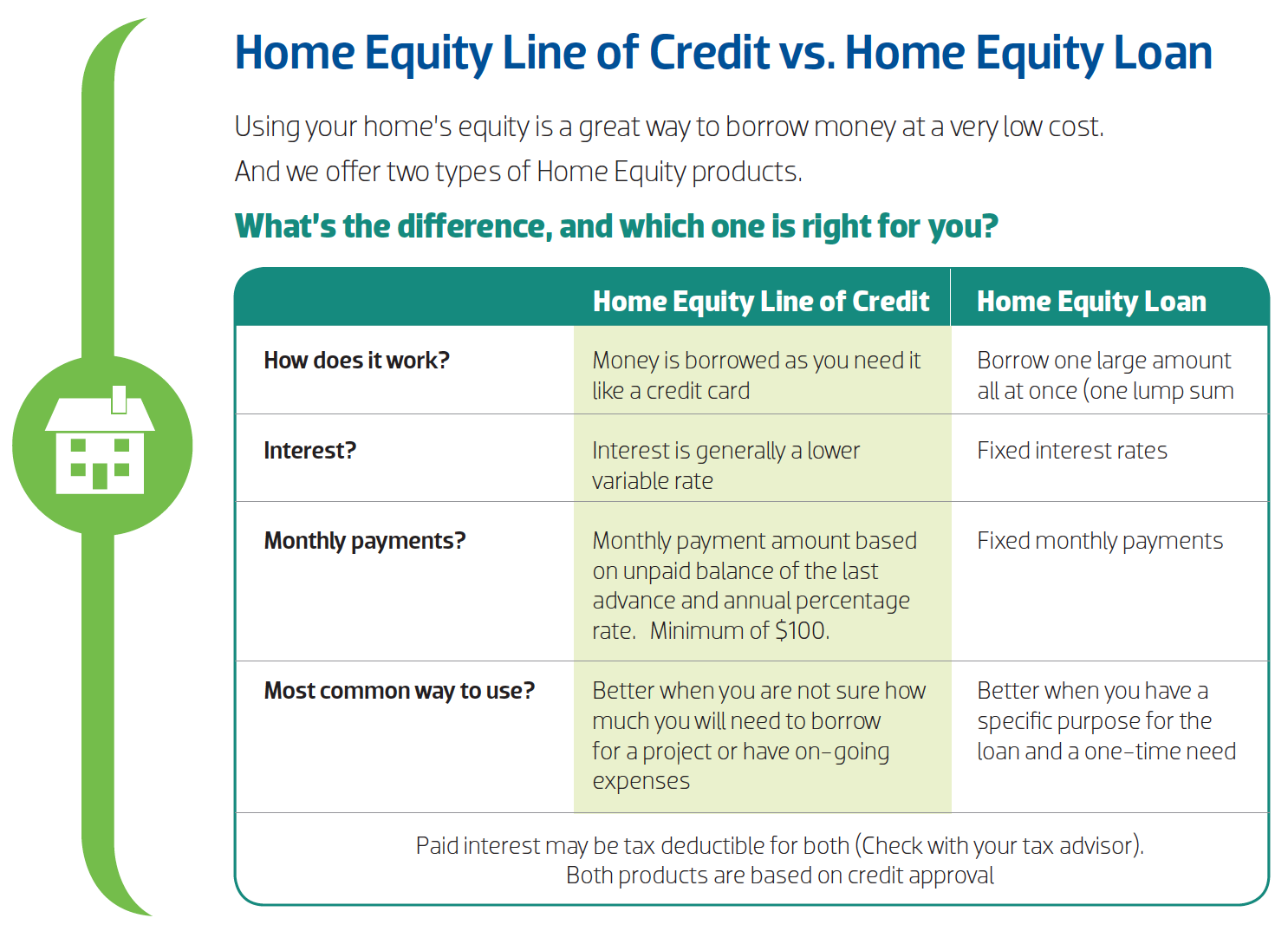

Mortgage Refinance Or Home Equity Loan Which Is Better For Me Mid Hudson Valley Federal Credit Union

Canadian Home Equity Loans Vs Reverse Mortgages Homeequity Bank

How Does A Home Equity Loan Work Overview And Process

Heloc To Pay Off Mortgage Bankrate

Home Equity Lines Of Credit Heloc Wesbanco

Using A Home Equity Loan To Pay Off Your First Mortgage

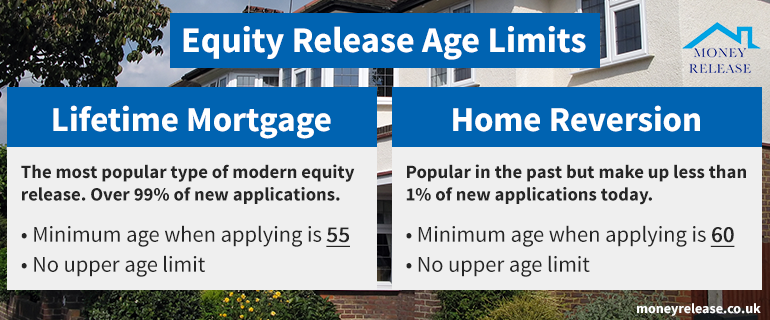

Equity Release Age Limits Table With Maximum Age By Lender

:max_bytes(150000):strip_icc()/GettyImages-1371914520-29b65a7cd16844f2bcf81cbbda108072.jpg)

Can You Get A Larger Home Equity Loan If Home Value Rises

5 Home Equity Loans For Bad Credit 2023 Badcredit Org

Reverse Mortgage Equitable Bank

Home Equity Community 1st Credit Union

Home Equity Line Of Credit Qualification Calculator